NFTs Explained: What New Investors Should Understand Before Jumping In

In the evolving world of digital ownership, NFTs explained simply means understanding how unique digital tokens are transforming how we view value, art, and even identity online. Whether it’s a $69 million digital artwork or a profile picture on social media, NFTs (non-fungible tokens) have sparked curiosity, skepticism, and intense debate. But what are they really—and should new investors pay attention?

What Are NFTs?

NFT stands for non-fungible token. The term “non-fungible” means that the item is unique and cannot be exchanged one-for-one with something else of equal value. In contrast, cryptocurrencies like Bitcoin are fungible: one BTC is always equal to another BTC.

NFTs are digital tokens stored on a blockchain, a decentralized ledger technology that ensures authenticity, ownership history, and transparency. While most NFTs are on the Ethereum blockchain, other blockchains like Solana, Polygon, and Tezos are becoming popular as well.

These tokens can represent ownership of almost anything:

- Digital artwork

- Music tracks

- In-game items

- Virtual land

- Tweets

- Domain names

But their most common use so far? Digital art and collectibles.

How NFTs Work

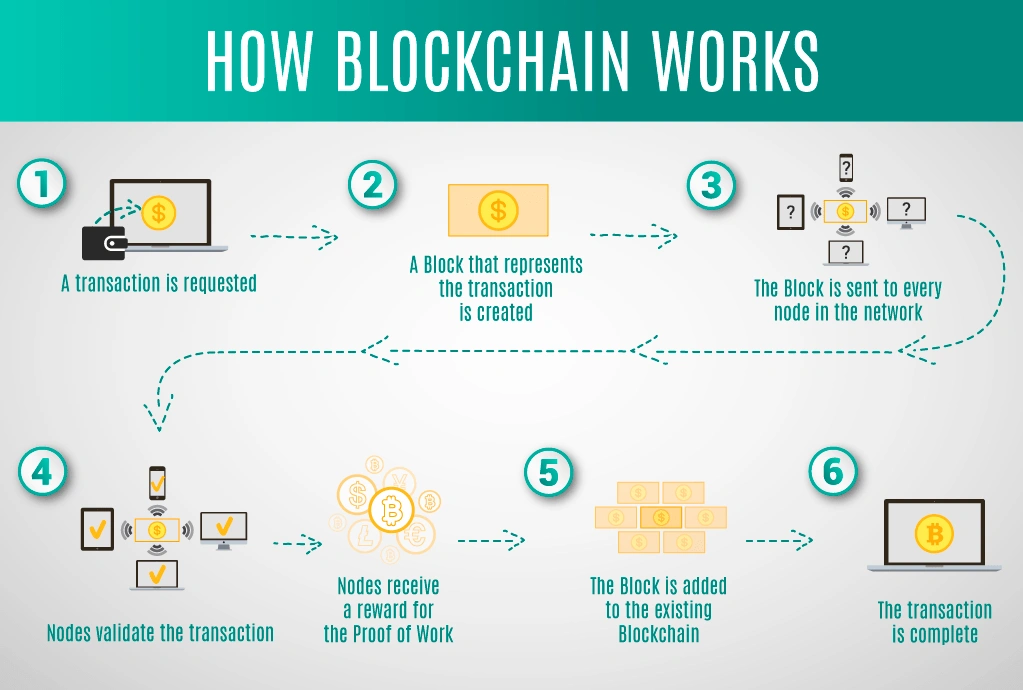

Credit from Energy & Capital

At the heart of NFTs is blockchain technology. Here’s how the process typically unfolds:

- An artist or creator mints an NFT — turning a file (e.g., an image, video, or music) into a token stored on the blockchain.

- That token includes metadata: the creator’s address, a unique identifier, timestamps, and any other relevant properties.

- Once minted, the NFT can be sold or transferred through an NFT marketplace like OpenSea, Rarible, or Magic Eden.

- Each transfer is recorded publicly on the blockchain, ensuring a verified record of ownership.

And unlike traditional art ownership, you don’t need a gallery or certificate to prove you own it — the blockchain is your proof.

NFT Use Cases Explained

While art remains the most publicized use case, NFTs are finding relevance across sectors. Below is a breakdown of how different industries are leveraging NFTs:

| Sector | NFT Use Case |

|---|---|

| Art & Collectibles | Digital art sales, ownership verification, creator royalties |

| Gaming | In-game items with real-world value, character skins, virtual land |

| Music | Tokenized albums, royalty tracking, fan experiences |

| Fashion | Digital wearables, authenticated ownership, limited-edition drops |

| Real Estate | Virtual property in the metaverse, digital proof of ownership |

| Events & Access | Tokenized event tickets, exclusive membership passes |

Why NFTs Have Value

The value of NFTs lies in three main elements:

- Scarcity: Most NFTs are issued in limited editions or as unique 1-of-1 items.

- Ownership: Blockchain ensures that you are the verifiable owner of that digital item.

- Utility: NFTs can grant access to content, communities, events, or even future profit-sharing.

Critics argue that anyone can copy-paste a JPEG, but owning an NFT is more like owning the signed original — not the screenshot.

NFTs vs. Cryptocurrencies

Though both operate on blockchain networks, NFTs differ from cryptocurrencies in fundamental ways:

| Feature | NFTs | Cryptocurrencies |

|---|---|---|

| Fungibility | Non-fungible (unique) | Fungible (interchangeable) |

| Use Case | Ownership of digital goods | Currency, trading, investment |

| Example | Bored Ape Yacht Club token | Bitcoin, Ethereum |

| Marketplaces | OpenSea, Blur, Foundation | Coinbase, Binance, Kraken |

Are NFTs Worth Investing In?

This depends on your goals. Some investors look at NFTs as digital art collections, others as speculative assets. A few invest for access to communities or future utility promised by creators.

However, many NFT investment guides stress caution. The market is volatile, trends change quickly, and scams do exist. Here are a few things to consider:

- Research the project: Who is behind it? What utility does it offer?

- Understand ownership: You own the token, not always the content.

- Check the smart contract: Some NFTs have embedded royalties or restrictions.

- Beware of hype cycles: What’s popular today may lose value overnight.

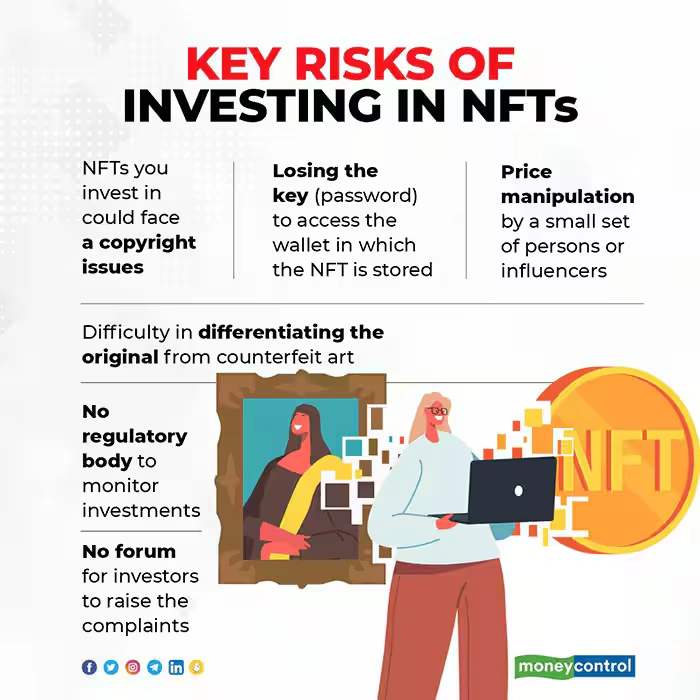

Risks of Investing in NFTs

Credit from Moneycontrol

Investing in NFTs carries real financial risk. Prices are driven more by community sentiment and hype than intrinsic value. Here are common risks:

- Illiquidity: You may not be able to resell your NFT quickly — or at all.

- Scams & fraud: Rug pulls and fake collections are rampant.

- Volatility: Prices can swing wildly in short periods.

- Unclear regulations: Legal frameworks around digital assets are still evolving.

Due diligence is essential. Use tools like Etherscan, Nansen, or Discord communities to evaluate projects.

How to Buy Your First NFT

If you’re ready to get started, here’s a simple process:

- Set up a crypto wallet like MetaMask.

- Fund it with ETH (or the blockchain-native token) using an exchange like Coinbase or Binance.

- Connect your wallet to a marketplace like OpenSea or Blur.

- Browse collections, verify authenticity, and check transaction history.

- Buy the NFT and store it securely in your wallet.

Remember: Never share your seed phrase, and double-check URLs to avoid phishing.

NFT Trends for New Investors

Several current trends are reshaping the NFT landscape:

- Dynamic NFTs (dNFTs): Tokens that evolve over time based on real-world data or usage.

- AI-generated NFTs: Combining generative AI with blockchain to create new digital art.

- Physical-backed NFTs: A digital token tied to a physical item, like sneakers or wine.

- Community-focused drops: Projects offering social benefits or shared ownership.

For new investors, these trends signal where the space may head — but also where risks may arise.

Conclusion: The NFT Landscape — Still Evolving

As blockchain technology matures, NFTs are carving out a real — though complex — place in the digital economy. From digital art to metaverse land, these tokens offer new ways to represent ownership, creativity, and value online.

For beginners, NFTs explained doesn’t mean jumping in headfirst. It means understanding the mechanics, the risks, and the culture behind them. The NFT space rewards curiosity and caution in equal measure — and for those willing to learn, it might just offer a glimpse of the internet’s next evolution.